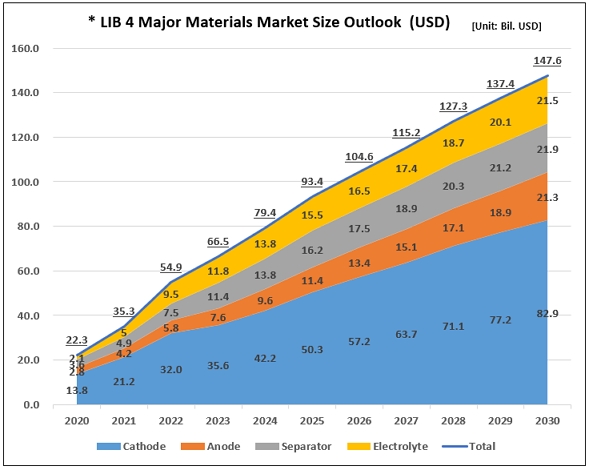

LIB 4 Major Materials Market Outlook

: Expected to Grow from US$ 54 billion in 2022 to US$ 147.6 billion in 2030

According to SNE Research, the 4 major materials for lithium-ion battery market recorded US$ 54.9 billion in 2022, which is expected to reach US$ 93.4 billion in 2025 and grow three-fold to US$ 147.6 in 2030 as the xEV battery market may expand beyond China and to the US and European markets, creating a continuous demand in materials.

The 4 major materials (cathode, anode, electrolyte, and separator) market accounts for 70% of the entire battery market. Among them, cathode material takes up more than 60% of the 4 major materials market, adding more significance to its presence. In fact, this is because the price of metals such as lithium, cobalt, nickel, and others is reflected to the cost of cathode material.

[Picture 1] LIB 4 Major Materials Market Size Outlook (2020~2030)

* Source: <2023> SCM Analysis and Market Outlook for LIB 4 Major Materials (~2030)

Among the global cathode material suppliers, ternary LIB materials were most shipped by EcoPro in Korea, followed by Umicore in Belgium, XTC in China, LG Chem in Korea, and Ronbay in China. In terms of LFP, Yuneng in China ranked top on the list, followed by Dynanonic, Guoxuan, BTR, and Lopal.

When it comes to anode materials, the market has been growing with major Chinese suppliers at the center; BTR, Zichen, Shanshan, and Kaijin. Hitachi and Mitsubishi from Japan, who used to be ranked higher, have seen a temporary decline in their shares in the global market, while POSCO Chemical from Korea has continuously made a progress in the market.

In the electrolyte market, the following companies enter the top 10 in the ranking; Tianqi, Capchem, Guotai-Huarong, ShanShan, BYD in China, MU Ionic solution, Central Glass in Japan, and Enchem and Soulbrain in Korea.

In the separator market, SEMCOPR in China holds a strong presence with No.1 production capacity among the market players, supplying to major battery companies such as CATL and BYD. In the past, the separator market was mainly led by major three companies, Asahi Kasei, Toray, and SKIET, but the market has recently seen a sharp growth of SEMCORP, Senior, and Sinoma in China.

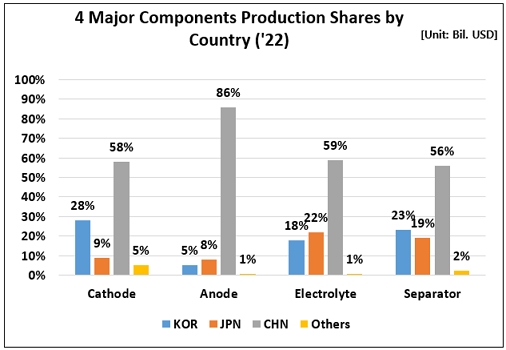

In terms of market price, shares of suppliers for 4 major components are dominated by those from three Asian countries: Korea, China, and Japan. Particularly, the dependence on Chinese suppliers is extremely high. (Cathode 58%, anode 86%, electrolyte 59%, and separator 56%).

[Picture 2] LIB 4 Major Materials Suppliers Market Share by Country (Based on Market Price in 2022)

* Source: <2023> SCM Analysis and Market Outlook for LIB 4 Major Materials (~2030)

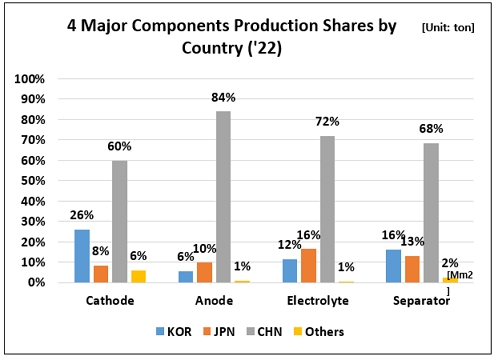

In terms of production volume, shares of suppliers for 4 major components are also dominated by those from three Asian countries: Korea, China, and Japan. Particularly, the dependence on Chinese suppliers is extremely high. (Cathode 60%, anode 84%, electrolyte 72%, separator 68%).

[Picture 3] LIB 4 Major Materials Suppliers Market Share by Country (Based on Market Price in 2022)

* Source: <2023> SCM Analysis and Market Outlook for LIB 4 Major Materials (~2030)

SNE Research sees the implementation of IRA by the US as a golden opportunity for the Korean battery suppliers to expand their presence in the market. With the implementation of IRA in the US and the Critical Raw Materials Act in Europe, the US and European markets are anticipated to be extending rapidly. Against this backdrop, battery makers from the three Asian countries – Korea, China, and Japan – have been moving swiftly to enter the US and European markets. Suppliers of 4 major components have been also quick to collaborate with each other and even directly with global car OEMs to make inroads into those markets.

In this regard, it is expected that material suppliers, who dominate those markets in advance, are highly likely to reshuffle the structure of industry in future.